The electric vehicle (EV) market in the United States has experienced significant growth in recent years, driven by technological advancements, government incentives, and increasing environmental awareness. However, this expansion also faces challenges related to charging infrastructure, government policies, and international competition, particularly from Chinese manufacturers.

Current Sales and Forecast for Electric Vehicles in the U.S

The U.S. EV market reached a historic milestone in 2024, with sales increasing by 7.3% compared to the previous year, totalling 1,301,411 units. The market share of EVs also saw a slight increase of half a percentage point, reaching 8.1% in 2024, up from 7.6% in 2023 (Híbridos y Eléctricos, 2024).

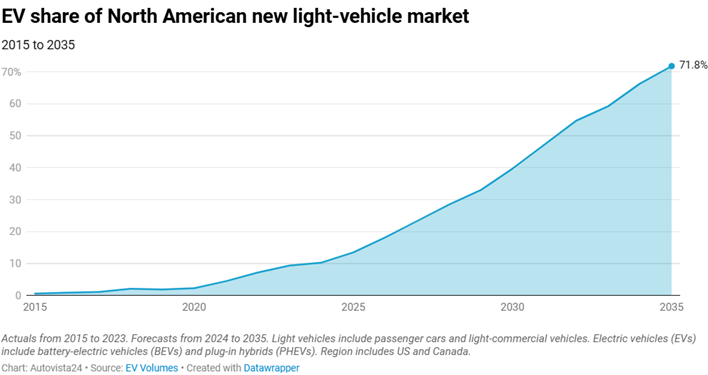

The overall recovery of the U.S. automotive market is expected to continue, albeit at a slower pace than initially projected. This deceleration has influenced EV market share and volume forecasts. In 2024, light-vehicle EV registrations are anticipated to grow by 12.8%, followed by a substantial 37.8% increase in 2025 (Autovista24, 2024).

Top-Selling Electric Vehicles in the U.S

Ongoing improvements in battery technology and increasing price competitiveness remain key drivers for EV market expansion. In 2024 alone, 17 new fully electric models were introduced. Despite growing competition, Tesla continues to dominate, selling 633,762 EVs, nearly half of all electric vehicles sold in the U.S. However, according to a report by Cox Automotive, most automakers experienced positive EV sales growth compared to 2023—except for Tesla, which saw a 5.6% decline in sales, marking a rare setback in an otherwise expanding market (Híbridos y Eléctricos, 2024).

The top-selling EV models in the U.S. in 2024 were:

| Position | Model | Units sold |

| 1 | Tesla Model Y | 372.613 |

| 2 | Tesla Model 3 | 189.903 |

| 3 | Ford Mustang Mach-E | 51.745 |

| 4 | Hyundai Ioniq 5 | 44.400 |

| 5 | Tesla Cybertruck | 38.965 |

| 6 | Ford F-150 Lightning | 33.510 |

| 7 | Honda Prologue | 33.017 |

| 8 | Chevrolet Equinox EV | 28.874 |

| 9 | Cadillac Lyriq | 28.402 |

| 10 | Rivian R1S | 26.934 |

The U.S. Pushback Against Chinese EVs: A Market That Barely Exists

The U.S. has imposed a 100% tariff on Chinese electric vehicles, quadrupling the previous 25% rate to block Chinese automakers. However, Chinese EV sales in the U.S. were already minimal before these tariffs (Xataka, 2024).

Chinese automakers face multiple barriers, including exclusion from the 2022 Inflation Reduction Act (IRA) incentives, which favor manufacturers with North American production. While companies like BYD have considered establishing plants in Mexico, Chinese EVs remain largely absent from the U.S. market.

As a Conclusion, the U.S. electric vehicle market continues to expand, driven by technological innovation, growing environmental awareness, and government support. While Tesla maintains its dominance, competition is increasing with several new models entering the market. However, challenges such as the need for more robust charging infrastructure and shifting government policies pose risks to sustained growth. Additionally, the U.S.’s firm stance against Chinese EVs, including high tariffs and exclusion from critical incentives, has ensured that the Chinese EV market remains largely non-existent in the U.S. The future of the U.S. EV market will depend on overcoming these hurdles while continuing to innovate and adapt to consumer demand.